Advisors live inside an ocean of internal notes, market research, regulatory updates, client meeting summaries, and investment rationale documents. The challenge isn’t collecting information — it’s retrieving the right insight at the right moment with full compliance confidence.

AskTuring gives Wealth Advisory, RIA, Asset Management, and Private Banking teams superhuman document intelligence powered by patent-protected RAG, multi-layer privacy, and precision citations — without exposing sensitive client data.

Book a Demo

Financial advisors need fast interpretation of internal research, policies, methodologies, and past decisions.

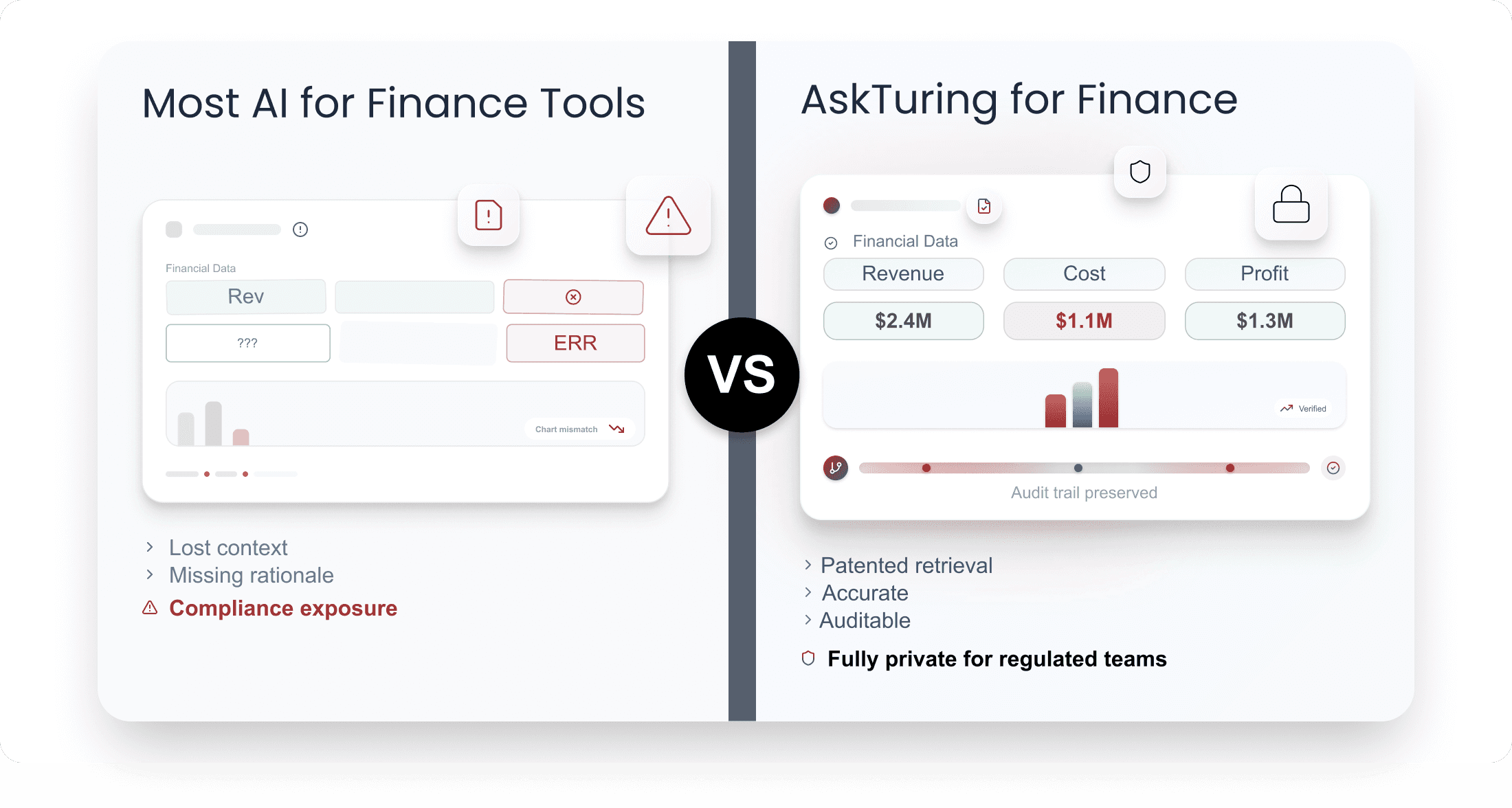

Typical RAG systems merge similar context, strips contextual nuance, and loses logic. AskTuring's intelligent segmentation preserves all regulatory relationships and compliance requirements intact.

Key capabilities:

Preserves MOAs assumptions and footnotes with disclosures maintaining ministerial rationale completely

Our risk frameworks ensure the AI understands not just what was said

Financial research is dense with compliance docs that are strict and nuanced. AskTuring's patented two-stage system automatically tags and filters for precision.

What it does:

Automatically tags and identifies the right document subset for accurate analysis

Retrieves only the most relevant sections reducing noise and improving accuracy

AskTuring is designed to operate around an LLM without ever storing data. It was architected from the ground up with multi-layer privacy guarantees.

Your data guarantee:

Full isolation of client data with encryption at rest and in transit

No data ever used for training models with stateless processing leaving nothing

Different client questions require different strengths including structured reasoning and narrative synthesis. AskTuring automatically picks the best LLM based on intent and performance.

Routing based on:

Some need structured reasoning while others require narrative synthesis or transformation

Intent and performance giving consultants the strongest reasoning engine for every query

Board-level recommendations demand confidence and absolute precision with zero room for error. AskTuring checks each factual claim across multiple LLMs consistently.

Outputs include:

Global confidence scores with fact-level reliability ratings for transparent decision support

Model-by-model agreement breakdown perfect for market claims and benchmark industry insights

Click straight to the exact source for complete traceability and verification. This makes validation fast, transparent, and client-safe.

Cites:

The exact table in a deck and the specific chart in a report

The right section in a playbook with the paragraph that defines framework

Book a Demo

Research Retrieval & Investment Rationale Summaries

Ask:

“Summarize our 2024 overweight thesis on emerging markets — cite from our research.”

Answer appears instantly, grounded in your own firm’s internal reports.

Compliance Rules & Policy Interpretation

AskTuring finds, explains, and cites:

KYC/AML rules

Suitability criteria

Firm-specific compliance guidelines

Disclosure requirements

Audit-ready documentation

Perfect for advisors needing real-time, compliant answers.

Portfolio Notes, Meeting Summaries & Internal Memos

Upload years of client files.

AskTuring retrieves:

Prior recommendations

Past decisions and reasoning

Risk tolerance notes

Performance discussions

Client objections and resolutions

Everything is cited and instantly verifiable.

Client Communication Drafts — Consistent & Compliant

Advisors get on-brand, compliant messaging grounded in firm-approved sources — never hallucinated or improvised.

Draft:

Market commentary

Quarterly updates

Investment explanations

Portfolio change rationales

Internal advisor notes

All with citations.

Faster Onboarding for New Advisors & Analysts

Junior team members can ramp up fast by accessing the firm’s entire knowledge base — organized, searchable, and instantly summarized.

Clients using AskTuring report:

See the Impact in 10 Minutes