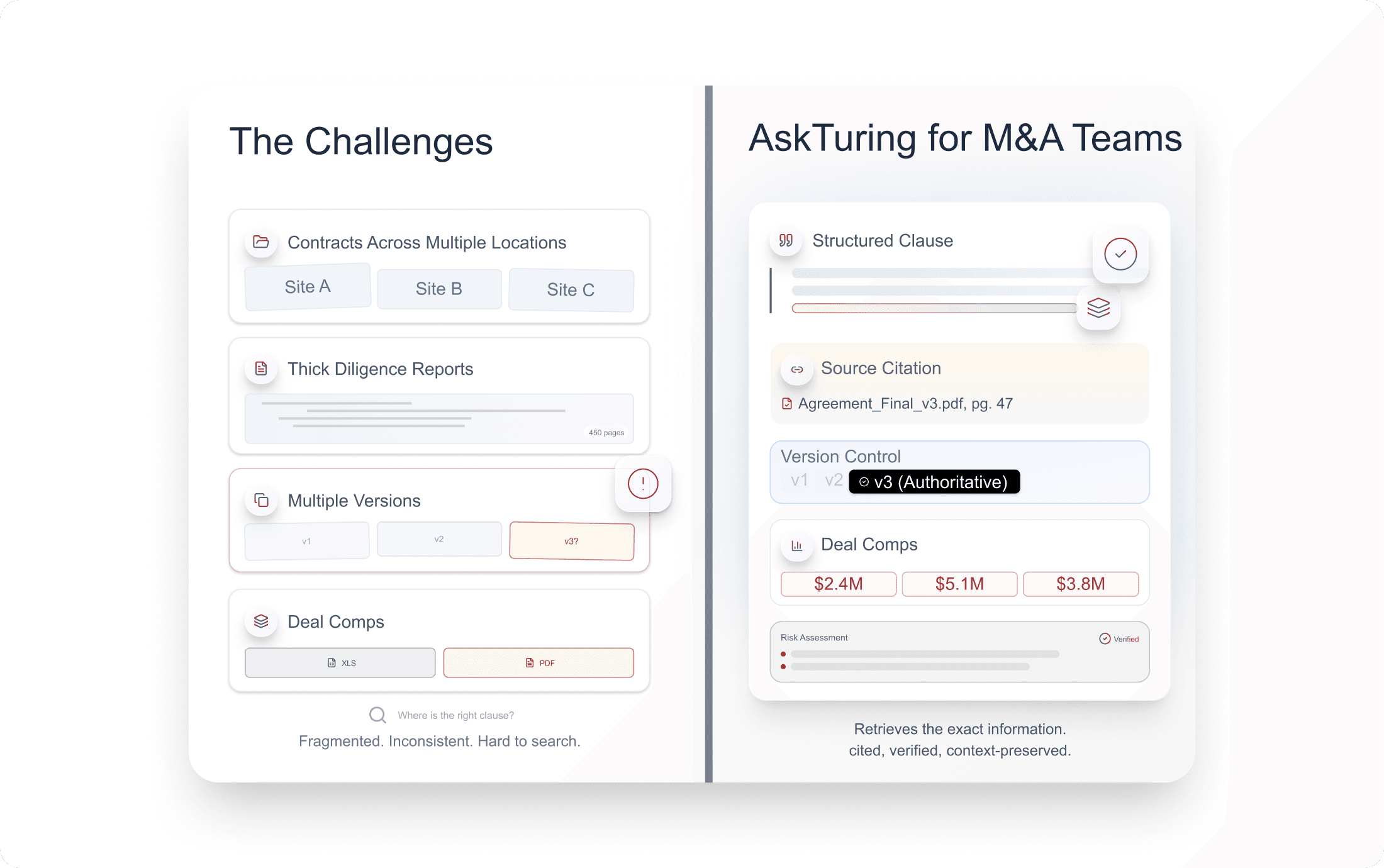

M&A and Corporate Development teams work under intense time pressure. You’re navigating deal rooms filled with contracts, financial models, prior transactions, redlines, diligence reports, risk memos, and historical analyses.

AskTuring gives deal teams an intelligent layer over their entire knowledge base — surfacing clauses, comps, issues, and insights instantly, with the accuracy and privacy required for high-stakes transactions.

Book a Demo

In M&A, information moves fast and risk is high.

AskTuring preserves the intricate relationships between M&A documents, NDAs, and due diligence materials. Your deal intelligence stays structured and instantly accessible.

Key capabilities:

Retains complex contract terms, clauses, and defined legal terminology across portfolios

Identifies market standards and risk patterns while preserving precedent logic consistently

AskTuring's process removes irrelevant noise and surfaces only what matters. Smart filtering delivers precise insights across complex transactions.

What it does:

Auto-tags and isolates the correct document subset for comprehensive analysis

Extracts only relevant sections: terms, obligations, conditions, and precedents

Deal documents demand absolute security and complete confidentiality. AskTuring guarantees ironclad data protection with persistent encryption.

Your data guarantee:

Never trains any LLM with your sensitive legal materials or transaction data

Encryption at rest and in transit with zero-trust architecture for complete privacy

M&A questions require sophisticated analysis across multiple dimensions. AskTuring selects the optimal LLM based on reasoning complexity.

Routing based on:

Reasoning complexity including multi-step legal logic and specialized domain terminology

Historical context with precedent analysis validated through live benchmarking continuously

Deal teams need certainty when reviewing critical agreements and clauses. AskTuring validates every response with transparent reliability metrics.

Outputs include:

Overall confidence score with fact-level reliability ratings for each cited claim

Model-by-model performance breakdown perfect for executive review and boardroom decisions

Every answer links directly to source documents for complete traceability. Verification becomes instant and eliminates guesswork entirely.

Cites:

Exact policy paragraphs and specific research sections with clause numbers clearly

Relevant case precedents with performance metrics tied to historical deal outcomes

Book a Demo

Deal Comps Retrieval

Ask:

“Show me the indemnification caps from our last 10 transactions.”

“What were the working capital adjustments in prior deals?”

“Summarize earnout structures across our last 5 acquisitions.”

AskTuring surfaces the exact clauses and supporting excerpts.

Contract Clause Analysis

Retrieve and compare:

Indemnity provisions

Limitations of liability

Termination triggers

Escrow/holdback terms

Non-compete / non-solicit clauses

All cited and context-preserved.

Diligence Summaries

AskTuring condenses:

Financial diligence

Legal diligence

Operational reviews

Tech assessments

Risk registers

Into accurate, cited, executive-ready summaries.

Integration Planning & Playbook Reuse

AskTuring pulls:

Past integration plans

Synergy assumptions

Operational risks

Post-close checklists

Process maps

This helps teams bring forward the best of prior deals.

Faster Decision Support for Execs & Boards

Executives want clear answers quickly.

AskTuring delivers accurate, cited insights pulled directly from real internal deal artifacts.

Teams using AskTuring report:

See AskTuring on Your Own Deal Materials